News & Trends

Bitcoin – an Investment Case?

Decyphering the Mystery for You

Bitcoin (BTC) is fascinating — but still an experiment. The probability of failure is still high. The chances of success, on the other hand, increase with every day that the number of users grows. A price of US$ 1 million per BTC in the next ten years is not entirely impossible but a crash from today’s level is also conceivable.

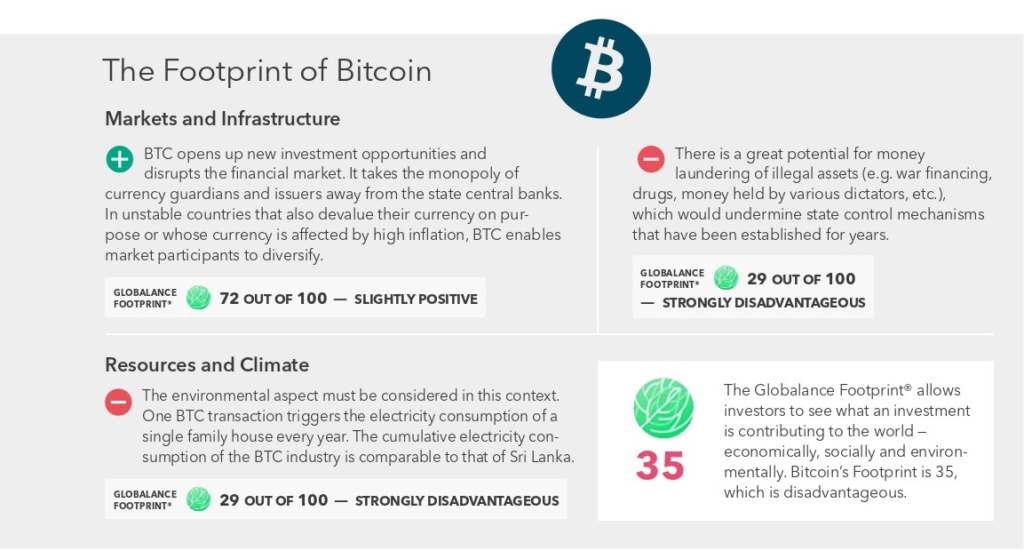

There is currently hardly an investment where the risk-reward ratio is so far apart. If you want to participate in this speculation, then an investment should not exceed one percent in view of the high probability of loss. And how should the footprint be assessed in view of the high power consumption or the possibity of illegal activities? We assess the current footprint to be negative — but should BTC establish itself in the mainstream, these shortcomings will also be addressed.

What Is the Case for Bitcoin?

The BTC blockchain seems comparable to the early days of the Internet in 1992. It is revolutionary, but its future potential is not yet recognised by the vast majority of people. The groundbreaking idea behind Bitcoin is a sovereign, decentralised platform. Stored transactions are immutable and the validation of new ones requires the confirmation of the broad community. Free from manipulation and independent of a central authority — these are the main arguments. Where can such a sovereign system add value? In many places. For example, personal data can be stored securely and managed by the owners, the life cycles of products can be traced seamlessly, or a global, non-political accounting and monetary system can be operated.

Why Bitcoin and Not Some Other Cryptocurrency?

We call it the first mover advantage. BTC has a market share of 66 percent among cryptocurrencies and is growing the fastest. The smaller the network, the higher the risk of someone taking control. So sheer size is the best guarantee to remain sovereign. BTC as a first mover has set the standard in the crypto landscape. It forms the basic structure, so to speak, on which new technologies are built.

How Can Bitcoin Fail?

In many ways. Takeover by a controlling party. Restriction by central banks. Replaced by a better network. Dilution of cryptocurrencies into fragmented players. And most importantly, the loss of confidence in its perceived value: if everyone expects BTC to lose value, it can become worthless. And: the more money is invested that investors cannot afford to lose, the higher the risk of a sell-off downwards as soon as sentiment changes.

Nowadays people know the price of everything and the value of nothing.

— Oscar Wilde

Doomed to Fail?

That would be going too far. BTC has a solid chance of not failing, but that does not necessarily mean it will become mainstream. For example, because governments and regulators keep it out of financial integration. Such a scenario is certainly conceivable — but in that case BTC would have a considerably lower price than today.

One Million per Bitcoin in a Few Years?

All the gold that has been mined so far is now worth US$ 7,000 billion. If BTC as a store of value were to reach the same valuation, 1 BTC would be worth US$ 300,000. Given the open structure and easy access, it does not seem too bold an assumption that ownership of BTC could spread three times faster than gold ownership. This would move the price of 1 BTC into the order of US$ 1 million.

The Art of Persuation

Anyone could launch their own cryptocurrency. The trick is to get enough people to accept it as the standard. There are thousands of cryptocurrencies out there today, but only three of them have a market capitalisation of more than ten billion US dollars — Bitcoin, Ethereum and Ripple. BTC alone holds a market share of two-thirds. This, however, is not enough in the long run. BTC will only be worth ”real“ money when three conditions are met. BTC must become accepted as a means of payment and/or store of value, there must be only a handful of successful cryptocurrencies and central banks as well as regulators must tolerate the existence of such an ”independent“ currency.

The expensive oblivion

How often have you forgotten a password or entered your PIN incorrectly? Do you know the stressful feeling of only having a few attempts left? Many Bitcoin owners, often from the early days, feel the same way — but with more serious consequences. Of the 19 million Bitcoins currently available, around 20 percent are considered lost, which corresponds to a value of around 210 billion US dollars (as of 25.03.2021). As the cryptocurrency was cheap at the beginning, the handling of it was often careless. Passwords of old storage devices were forgotten and hard drives with thousands of Bitcoins were disposed of.