News & Trends

Investors Need Data to Look into the Future

Investors Need Data to Look into the Future By Thomas Pfyl and Gian Andro Pfister, first published in “Reporting Insights” of the Center for Corporate Reporting.

Companies publish vast amounts of ESG (Environmental, Social, and Governance) data. However, investors and asset managers are often left underwhelmed. They lack compelling information on how sustainability issues relate to the future competitiveness of companies. Thomas Pfyl and Gian Andro Pfister from Globalance explain what companies can do to fill this gap.

Collecting sustainability data and creating sustainability reports have become crucial tasks for the respective departments in publicly traded companies. This involves a lot of work and considerable time investment, with the data volumes increasing year after year—mainly due to growing regulations. Against this backdrop, it seems almost tragic that the ESG data published by companies often leaves many investors and asset managers disillusioned.

The reasons for this disillusionment: many data points are indeed useful, but they are not sufficient as a basis for robust analyses and investment decisions. This is because most traditional ESG assessment data evaluates the risk of relevant environmental impacts on a company’s financial situation—thus, they are predominantly backward-looking.

What is often missing in companies’ reports and investor pitches are compelling details on how relevant sustainability issues relate to a company’s future competitiveness. ESG data alone do not cover this topic. Thus, companies often lack meaningful arguments on whether and how they will seize future opportunities and succeed in a changing world. What’s important for us is the answer to the question: How do companies position themselves with their strategy and business model to benefit from global megatrends and address sustainability challenges?

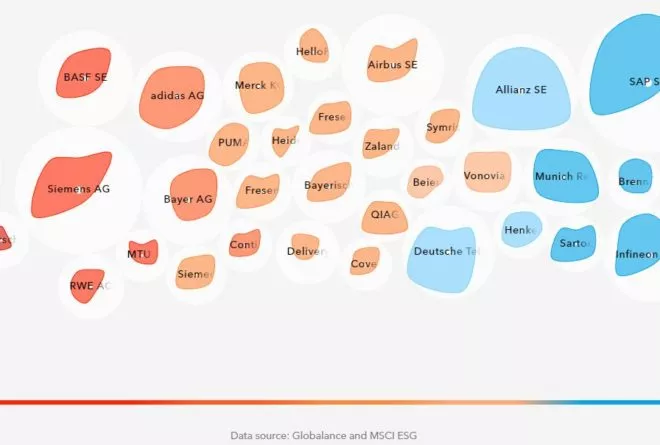

Not only for us at Globalance is this a central factor in preparing investment decisions. Companies miss an opportunity if they do not convincingly answer these questions for investors and asset managers. Globalance wants to invest in companies that help solve the major challenges of our time. For this, we need data that allows us to look into the future. So: What makes the company future-proof? We, for example, calculate the revenues that companies are already generating today in connection with megatrends such as urbanization, demographics, resource scarcity, and digitalization. For us, sustainability means not only risk management but also opportunity analysis.

Thus, it is not decisive for us if a bank states in its sustainability report that it is consuming less electricity at its office locations. This says nothing about the future viability of the business model. What matters is the answer to whether the bank focuses on financing companies that offer sustainable products and services—such as manufacturers of electric vehicles and charging infrastructure instead of manufacturers of combustion engine vehicles.

What information is essential in this context varies from industry to industry. In pharmaceuticals and medical technology, access to healthcare is a priority; in transportation, scaling smart mobility is key, and food companies must provide information on resources and healthy products.

We also apply the principle of materiality to understand the impact of companies on climate change. Therefore, we not only consider how much CO2 a company emits directly (Scope 1+2) but also analyze the emissions caused by the product or service across the entire value chain (Scope 3). Additionally, we scrutinize companies’ emission reduction targets for the coming years and assess their credibility—to identify firms with unrealistic goals.

The results of these analyses on the impact of companies on the economy, society, and the environment are incorporated into our self-developed Globalance Footprint. The better and more relevant the information we receive from companies, the easier our analysis becomes.

Of course, we are aware that compiling relevant data is not always easy for companies. For example, they often face the challenge that the positive impact of a product or service cannot be measured empirically. However, even then, they can provide investors and asset managers with relevant information. Qualitative statements can often help capture a positive impact. An example of this is the so-called avoided emissions: when lower-emission technologies, such as solar power generation, are used, emissions are avoided. Companies like the electrical engineering group ABB provide rough estimates of the emissions saved. A successful example of how a company makes its most important performance from a sustainability perspective visible in addition to the conventional ESG data. And an example that the essential can be recognized even without striving for the greatest possible accuracy.

We are convinced: It is crucial for companies to provide such information in addition to the usual ESG data. We use them when creating a profile for companies that considers both quantitative data and qualitative analysis. We proceed according to the principle of materiality. And this means: Companies have a clear advantage if all relevant information about their business model and strategy is available to us.

Recommendations for Companies

The amount of ESG data is steadily increasing. Not all of it is relevant for investors. Critically examine which data this target group really needs.

For investors, ESG data is necessary but not sufficient. They also need information about the future viability of the business model. Make this information part of your investor pitch and clearly explain the relationship between sustainability issues and future competitiveness.

Qualitative statements are relevant for investors if common sense can grasp the positive impact of products—even if direct causality cannot be empirically proven. Make such statements in your investor pitch.