News & Trends

Blockchain Makes Intermediaries Superfluous

Tokenisation Revolutionises the Investment Markets

Blockchain technology provides considerable surprises, time and time again. But the real revolution is taking place quietly. And concerns pretty much everything that has to do with financial transactions.

A “digital democratisation” of investment forms and classes.

When a work is auctioned for USD 64 million, it is no longer that much of a surprise in the art world. But if this is a purely digital work, a collage of 5,000 images clicked together, it will raise eyebrows even on the international collector scene. Especially since the work “The First 5000 Days” by the artist Mike Winkelmann alias Beeple is provided with a new type of stamp, a so-called token. To be precise, a non-fungible token (NFT), which turns the flood of images into an “irreplaceable” digitally protected object.

NFT: a non-fungible token is a unique, non-exchangeable cryptographic unit. A physical equivalent to this would be, for example, the “Girl with a Pearl Earring” by Vermeer. On the other hand, a bank note like a 1 dollar note is completely “fungible” — each one is as good as the other.

These NFTs turn copyable digital art into a clearly identifiable and thus tradable individual piece. The peculiarity of putting a stamp on an object that cannot be copied, hacked or destroyed is probably the real reason why the Beeple auction at Christie’s caused such a stir.

Hardly Any Limits for the NFTs

What else can be commercialised with NFTs? There are hardly any limits to the imagination: so far, songs, the source code of the World Wide Web, pixelated heads and much more have been sold. This has long since become a cross-sector trend, which is summarised under the buzzword tokenisation. The concept can be applied in many areas — and will also affect the financial world.

Fintechs have just started to challenge the established institutions in niches such as payment transactions. But, the banks and insurance companies have not yet felt the full force of the disruptive potential of digitization — as the retail trade or the media industry already have.

Intermediaries No Longer Necessary

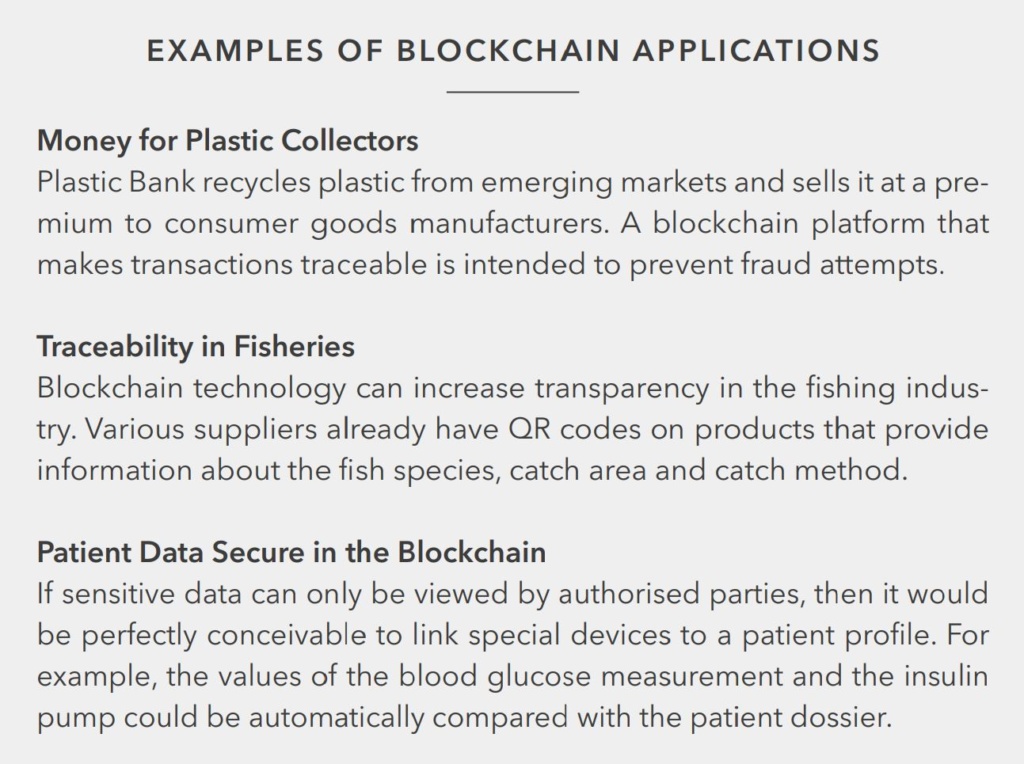

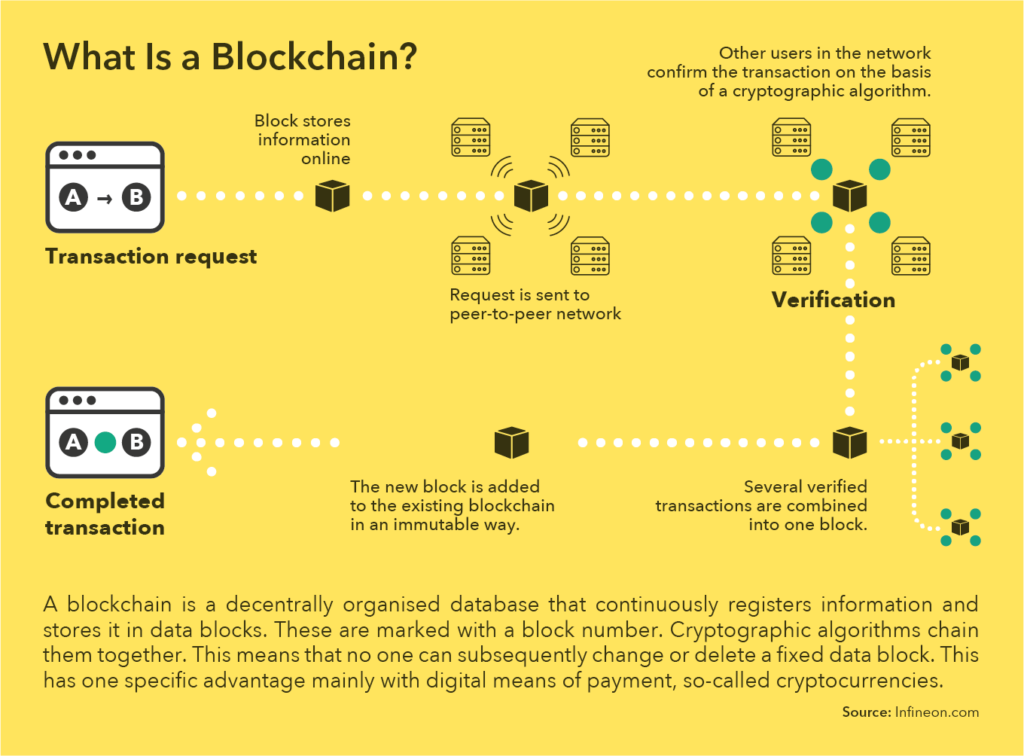

Tokenisation could now also bring about change here. The principle works like this: real assets are converted into smaller virtual units and the property rights tied to them are traded using a blockchain. A token itself has no intrinsic value, but is linked to the price of the underlying asset.

Theoretically, all possible assets can be mapped. In addition to art, these can also be cars, real estate or intangible goods such as royalties, but of course also stocks, options or bonds. In the world of tokenisation, these digitally recorded values are called crypto-assets.

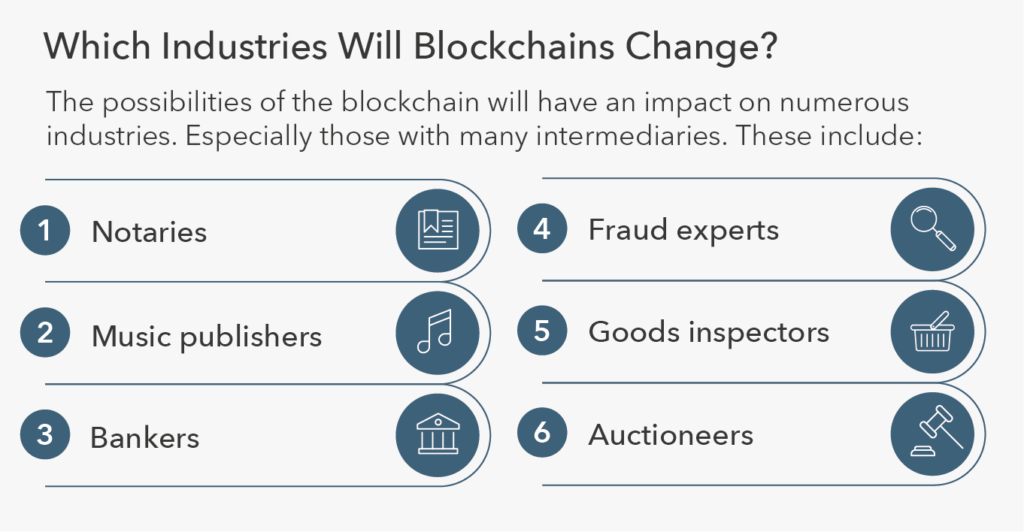

In contrast to the traditional financial system, no intermediaries are needed for tokenisation, as transactions take place exclusively using the blockchain and therefore through open software protocols and decentralised structures. And that is precisely where the real disruptive core of the technology lies. A decentralised financial system (DeFi) can be built upon it that manages wonderfully without intermediaries. The DeFi could unleash the power to tear down today’s financial architectures. Banks, insurance companies or stock exchanges could become superfluous, as their previous functions can be mapped in a blockchain structure.

New Perspectives for Investors?

New perspectives are opening up for investors: tokenisation also allows them to invest in a fraction of an asset and expand portfolios with asset classes that were previously out of their reach. Tokenisation makes it possible for investors to hold shares in sailing yachts or apartment buildings.

In this context, people like to talk about a “digital democratisation” of investment forms and asset classes that previously only had limited liquidity or required high minimum investment amounts. The business models of traditional asset managers and specialised investment banks could come under pressure.

There is still a long way to go before a decentralised financial system becomes reality. Regulatory provisions still partly require crypto-assets to be traded via intermediaries such as banks (hashtag: money laundering). The technology is still young, but as it matures, it could unleash immense power.