News & Trends

Sustainability Pays Off

ESG HAS PROVED ITSELF AS A CRITERION FOR BETTER RETURNS — The ESG approach has even proven its resilience during a multitude of crises.

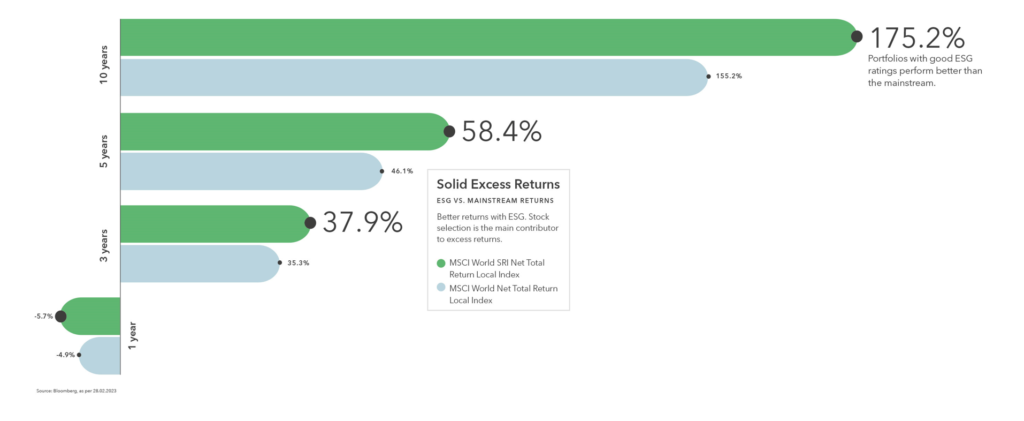

First things first: sustainable equity strategies beat the broad market in both the long and short term. This was the result of a comparison of the MSCI SRI global sustainable equity index with its conventional counterpart MSCI World. According to this, the forward-looking SRI outperformed the mainstream world equity index by a whopping 20 percent over a ten-year period. Even with an investment horizon of three (+2.6%) and five years (+12.3%), sustainability paid off as a strategy. But the investors’ motivation to invest sustainably is not only financial. The monetary return is further enhanced by the positive impact on the economy, society and the environment. Sufficient capital in the right channels drives innovation and helps solve problems

Stock Selection More Important Than Sectors

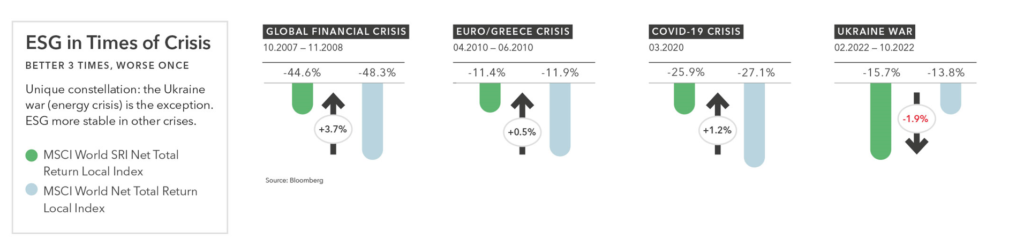

So what makes sustainable investments fundamentally more successful than conventional ones? The selected business models are on the one hand future-oriented and on the other hand also sustainable in an economic sense. With this combination, the selected companies are making a significant contribution to the necessary transformation of our world and they are also attractive investments at the same time. The excess returns demonstrably stem from the selection of individual stocks and not from the overweighting of individual sectors. A good two-thirds of the excess returns within five years was consequently attributable to stock selection. The sector weighting, on the other hand, played a subordinate role. Even crises such as the global financial crisis in 2008, the euro crisis in 2010 and, most recently, the COVID-19 crisis have affected ESG* investments less in recent years. As the chart shows, the share price also suffered on the MSCI SRI after these events, but less so than on the MSCI World. The only exception was last year, 2022, which was due to the Ukraine war and the related energy crisis. This exceptional geopolitical situation gave fossil fuels unprecedented excess returns in the short term, benefiting the broad world equity index, but the MSCI SRI much less.

Beware of Diluted Indices

But be careful: not everything claiming to be ESG has the same amount of ESG in it. While the MSCI SRI approach only admits the top 25% per sector in terms of ESG, the admission hurdles for the MSCI ESG Leaders and MSCI ESG Screened approaches are much more lax: for example, the best 50 or even 90 percent are included in the respective index. The higher the percentage of selected companies, the greater the dilution and the more similar the composition is to that of the conventional world equity index. The fact that this dilution is at the expense of returns can be seen in the performance over the past ten years.

But even the best ESG approach is not immune to loopholes. By selecting the best companies from each sector, fossil fuel players are inevitably finding their way into the index. The crux: even the “best” coal-fired power plant among its peers is still a coal-fired power plant. ESG therefore has its limits with this best-in-class model.

New Solutions in the Starting Blocks

Under the leadership of the Swiss Confederation, experts from the sector have therefore developed a solution that takes the sustainability of investments further and is aligned with the Paris Climate Agreement. The so-called Swiss Climate Scores take into account a company’s greenhouse gas emissions, its share of fossil fuels and its strategy for global warming, among other things. Those who achieve the targeted score also have credible climate management and are committed to the global net-zero target. This finally creates the necessary transparency for investors — a long overdue comparability that Globalance already offers its clients today.

*ESG = Environmental, Social & Governance

THE GLOBALANCE VIEW

ESG approaches have an advantage over conventional, pure market cap-weighted approaches thanks to successful stock selection. The excess returns are demonstrably due to the consideration of ESG criteria in the selection and investment process. The selected business models are more future-oriented and at the same time more economically viable. Companies with operational weaknesses and reputation risks can be identified and weeded out in good time due to weak ESG ratings. For investors, it is important to realise that shares with good ESG ratings perform significantly better on the stock market than companies with weak ratings.

Nevertheless, ESG approaches can still be optimised. Globalance extends the relative view with an assessment of a company’s absolute impact. Only the absolute view makes it possible to select those companies that are already relying on the right technologies today and are no longer weighted in the old world of fossil fuels.

If you want to successfully build and preserve wealth today, you have to realign your investments. Would you like to learn more about Globalance’s investment philosophy? Or would you prefer a personal consultation on this exciting topic?

Weitere interessante Themen finden Sie in unserem Zukunftbeweger Magazin.