News & Trends

Fears of Inflation in the Focus

Excessive inflation rates are bad for the capital markets. They translate into higher nominal interest rates that put pressure on the prices of stocks and obligations, and they force central banks to normalise their expansive monetary policy. But only if the price increase is sustainable.

Is Inflation Here to Stay?

The market will continue to be strongly dependant on the success in containing the pandemic. Vaccination campaigns further improved the outlook for the economic development and the global economy is recovering quickly. While that is positive news, it also results in cyclical inflation risks, in which the extent and the duration of such inflationary effects are the decisive factors.

Impaired Supply Chains Indicate “Bottleneck Inflation”

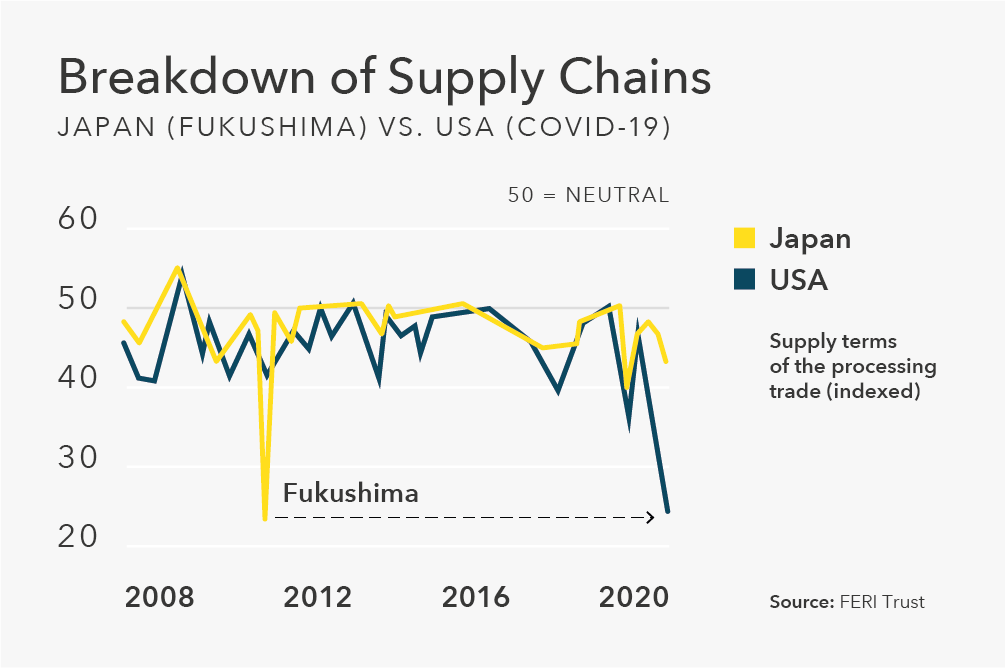

Many suppliers drastically reduced their capacities during the pandemic and are currently unable to meet the resurging demand. Supply chains in the US are similar to the total breakdown in Japan after the Fukushima reactor accident (see the figure below). As a consequence, prices rise sharply in many sectors; a classic bottleneck situation. There is considerable evidence that the current inflationary development will be a temporary one. As soon as the offer side realigns itself newly and logistics chains work smoothly again, inflation rates should level off at lower levels.

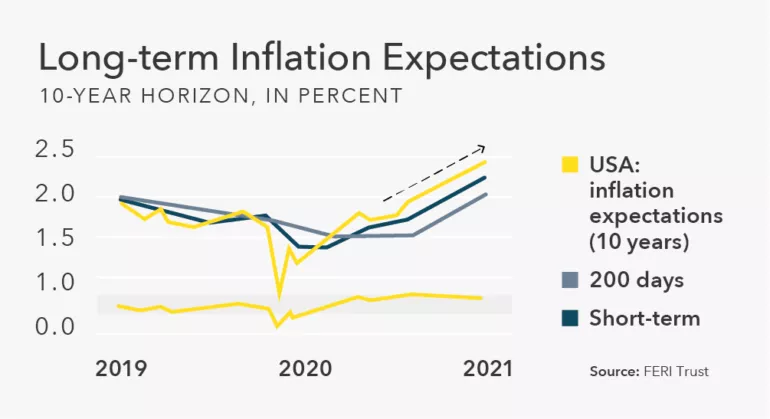

Market Cautiously Positive

Even the financial markets are currently not anticipating a sustained increase in inflation rates. Inflation expectations are on the rise — but only to a healthy 2.5 % over the next ten years (figure).

Constructive But Volatile Second Half of the Year

Rising interest rates, a potential reduction of bond purchases by the central banks or temporarily further rising inflation rates might cause higher volatility at the markets during the second half of the year. Nevertheless, the overall picture remains positive. We are in the middle of a cyclic upturn. The profit situation of companies has improved significantly and the economic recovery is different by geographic regions (China before the USA before Europe), which will prolong the cycle.