News & Trends

The World Switches On the Climate Turbo

The CO2 Price Drives Decarbonisation

A superficial look at the development of the CO2 price is deceptive: capital markets have anticipated a multiplication to USD 200—300 per tonne in the long term and are directing capital away from oil and gas into building a lowcarbon energy infrastructure.

At the end of 2020, Swiss reinsurance group Swiss Re hit the international headlines — and not “for nothing”. In fact, it was the first multinational company to set its internal CO2 price at a remarkable USD 100 per tonne at the beginning of 2021. It plans to climb to the next level of USD 200 by 2030. These kinds of clear strategic realignments are needed from large corporations in order not to water down the targets of the Paris Climate Agreement.

This step sent out an important message that resonated far beyond Swiss Re. For, on the one hand, a high CO2 price reflects the considerable costs of fossil energies for people and the environment. And, on the other hand, only a high CO2 price makes the clean alternatives relatively cheaper.

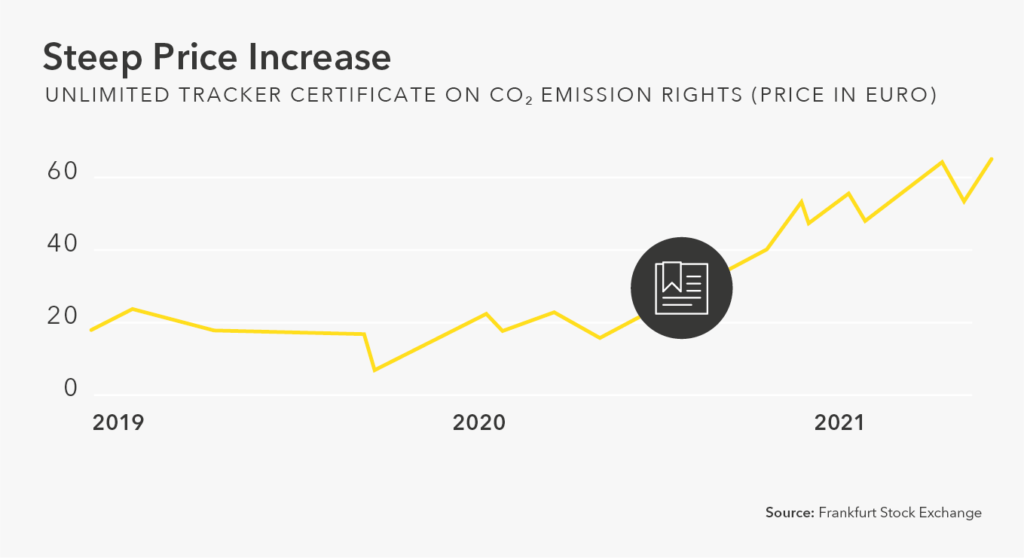

Swiss Re’s action was taken at a time when the market price in the European CO2 trading system was still around USD 25 per tonne and the global average price was around USD 5 for the same quantity. Three quarters of all global emissions would therefore be “free” because they are neither taxed nor recorded by a system.

The gap between the costs of energy projects in the “old” and the “new” world is noticeably widening.

The (Almost) Unnoticed CO2 Pricing

But that is only half the truth. Because amazing things have happened on the global capital markets, almost without anyone noticing. An implied CO2 price of USD 80-100 has apparently been anticipated there for at least ten years. This is the conclusion of Michele Della Vigna, head of Goldman Sachs’ highly regarded “Carbonomics” programme.

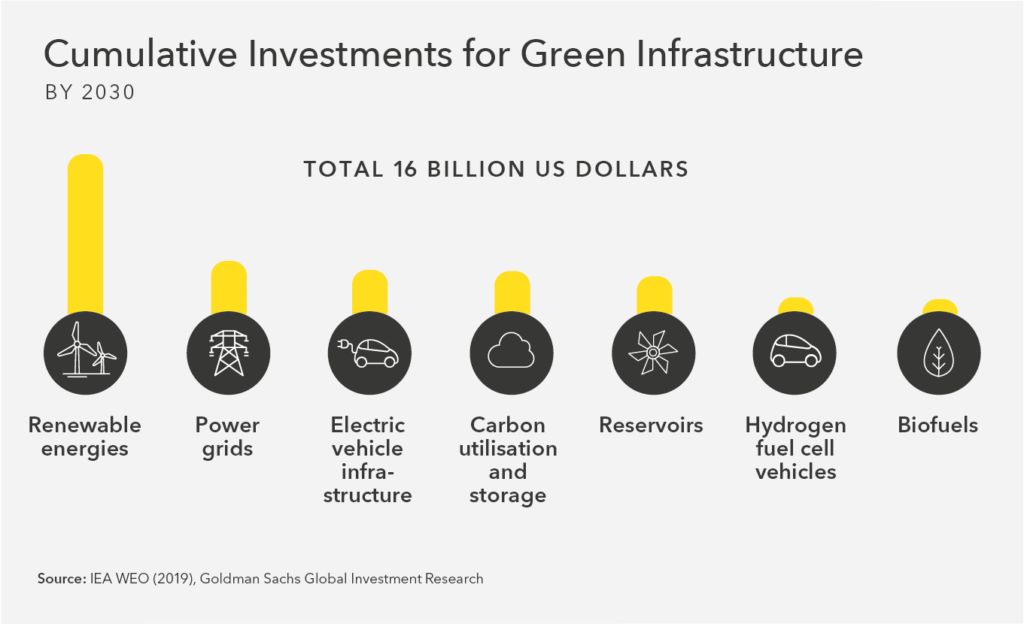

As a starting point, he takes the average capital costs of eight to ten percent that were common for investment projects in the oil and gas sector just ten years ago. These have now increased to around 20 percent, while the costs of renewable energy projects have fallen to between three and five percent over the same period.

The gap between the costs of energy projects in the “old” and the “new” world is noticeably widening. Investors want to be compensated because they see much more risk in oil projects given the 1.5 degree target. As a result, only the most financially attractive fossil energy infrastructure projects can be financed.

Pay Up Please

Meanwhile, the price in the European CO2 trading system also increased noticeably to around EUR 60 per tonne. Since the total amount of emission rights is regularly reduced, this increase is related to technical aspects. Nevertheless, it also reflects the economic and political reality. And the price will still rise to USD 200—300 per tonne, so that the more expensive solutions for emission reductions can also be implemented financially without delay.

Both the real economy and financial investors have to adjust to this (see also “CO2 certificates as a financial investment — a good idea?” info box).

The Course for “Low Carbon” Is Set

There is still the need for a global system to regulate standardised carbon prices. So far, the EU has the most important one. But China also launched its long-awaited trading system this summer. However, there are two major hurdles to overcome on the road to a global system.

If we want to get over the first one, an international compensation mechanism must be agreed so that countries with a high CO2 price are not disadvantaged. The EU is at the forefront and has already announced import tariffs on carbon-intensive products (“Carbon Border Adjustment Mechanism”). The second hurdle is the social disadvantages of high CO2 prices, which need to be alleviated. One possibility is the incentive tax instrument, which can prevent the most vulnerable from suffering most from higher prices. The course is set: a much higher CO2 price will become reality sooner than some might have expected. The falling capital costs to build the low-carbon infrastructure, however, are in direct correlation with the likewise levelling-off technology costs. A combination of the two raises justified hope that the dramatic transformation of the global economy can succeed by 2050.