News & Trends

Giving Nature a Price

Carbon Pricing

Carbon pricing aims to reduce greenhouse gases. Market mechanisms are used to pass on the costs of pollution to the direct polluters and to control their behaviour with financial incentives.

Carbon pricing is therefore an effective instrument for combating climate change. It opens up the potential to decarbonise the world’s economic activity by changing the behaviour of companies and investors. At the same time, technological innovations are being released and income is being generated, which can be used productively. In short: well-structured carbon prices protect the environment and encourage investment in clean technologies.

How Do Carbon Pricing Instruments Work?

An emissions trading system – also known as a cap-and-trade system – sets a cap on direct carbon emissions per sector and establishes a market in which emissions allowances are traded in the form of certificates. A carbon certificate entitles companies to one tonne of carbon dioxide emissions. The current challenge is global implementation across the board. This is because an inconsistent patchwork of regionally different carbon pricing guidelines offers climate sinners too many loopholes to shift their activities to cheaper or unregulated countries.

Advantages for Investors

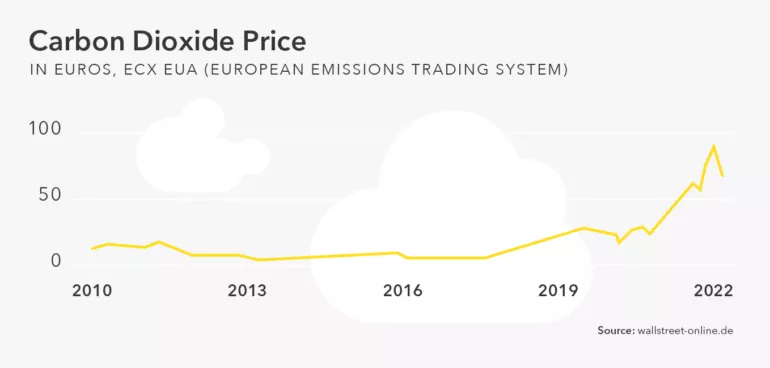

Carbon pricing opens up a new asset class for investors. For example, there are now a number of investment products that track the carbon certificate price development (see diagram).

For investors, certificates offer the advantage that their price development has barely any correlation with other investments such as shares, bonds or precious metals and thus ensures diversification in the portfolio.

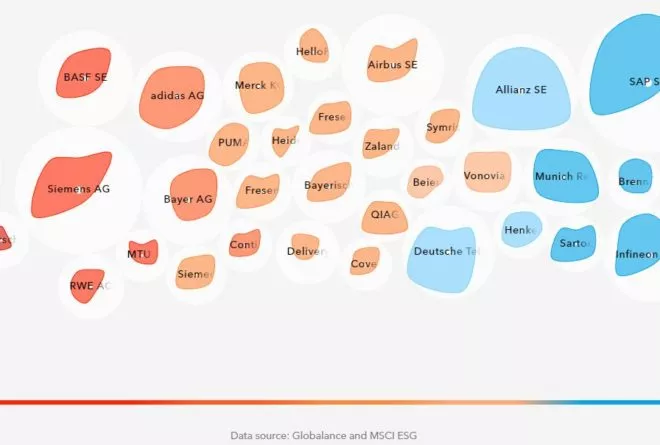

Carbon certificates in Europe

Around half of Europe’s greenhouse gas emissions are regulated with such certificates at over 11,000 companies. Companies may not emit more CO2 than they have received allowances for, otherwise they must buy additional allowances through state auctions or the ETS emissions trading system.

The aim of this system is to create market-based incentives to reduce greenhouse gas emissions. The fundamental driver of the certificate price is the politically intentional, constant shortage of the supply of certificates issued. From 2024, they are to be reduced by 4.2% each year.