News & Trends

Digital Money

Everything Crypto or What?

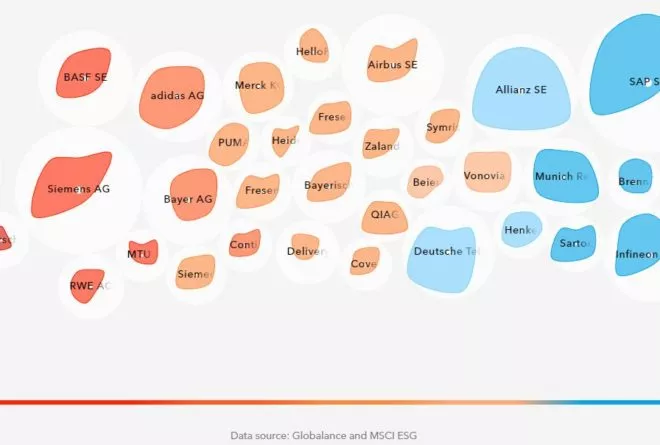

Physische und mentale Fitness, Vitalität und ein gesunder Lebensstil stehen hoch im Kurs. Digital developments like Bitcoin and Blockchain could revolutionize the monetary system. Facebook is also announcing Libra, a private currency that would be linked to an asset or basket by means of stablecoin, which would eliminate the volatility associated with virtual money. PayPal is in no way inferior to this development and will also offer a crypto service in the future. But what actually distinguishes private virtual money from our conventional currencies?

Money is a social convention and is based on trust. Fiat currencies are declared legal tender by governments, they are an integral part of modern economies and are issued by central banks. We accept them in exchange for goods and services, in the confidence that our fellow human beings will show the same acceptance. This is because national currencies do not have any intrinsic value. Rather, it is the belief in a long-term stable price level and confidence in the guardians of the currency that keep the value of money stable. Proponents of crypto-currencies regard the fiat money system as inherently unstable and susceptible to inflationary risks, and regard it as an inefficient payment system. Crypto currencies, on the other hand, have a limited number of digital units, which is why they are often said to be deflationary in nature. Digital currencies are also intended to provide broader, easier and cheaper access to financial services. While 1.7 billion people worldwide still do not have adequate bank accounts, hopes are pinned on technical innovations to increase connectivity — the cell phone as a payment method.

Transactions Made Easy

There is no central governing body for crypto currencies. Bitcoin and Co are based on the block chain, a kind of decentral database on which all transactions are stored. This is intended to provide increased transparency and, in the best case, help reduce tax offenses and money laundering. The increase in efficiency with direct peer-to-peer money transfer is also highlighted by its advocates — transfers within seconds, without involvement of a bank and high fees. However, many recognize a potential threat to financial stability if digital currencies become stronger and increasingly diverge from the traditional financial system. A wake-up call for politicians and central banks?

Digital Money under the Supervision of Central Banks?

However, potential regulation of digital money should in no way slow down technological progress. The new technology’s potential for greater efficiency, reliability, security, speed, and flexibility must be fully exploited. Is the international monetary system at a crossroads and will digital central bank money follow in the future? With regard to the Chinese and Swedish pioneers, the way forward can be clearly seen.

In a few years we will have a digital Euro.

— Christine Lagarde, President EZB

China’s central bank has a sporting chance of managing to introduce digital currency electronic payment for the 2022 Winter Olympics. Unlike crypto currencies, however, this digital currency would remain under the supervision of the central bank. A pilot project is also already underway in Sweden using a blockchain currency. A decision about the output of the E-Krona is not yet available. More than 70 percent of central banks are currently examining the merits of their own digital currencies (CBDC).